7 Essential Tips for First-Time Homebuyers in San Antonio

As a real estate agent in San Antonio, I’ve seen many first-time homebuyers embark on their journey to homeownership. It’s an exciting but often overwhelming experience, especially for those who are new to the process. In this blog post, I’ll share my 7 essential tips to help first-time homebuyers navigate the market and achieve their dream of owning a home.

- Get Your Finances in Order

Before starting your home buying journey, it’s crucial to get your finances in order. This includes checking your credit score, paying off any outstanding debts, and building an emergency fund. Aim to save at least 20% of the purchase price for a down payment and closing costs. As a general rule, lenders prefer borrowers with a credit score of 700 or higher.

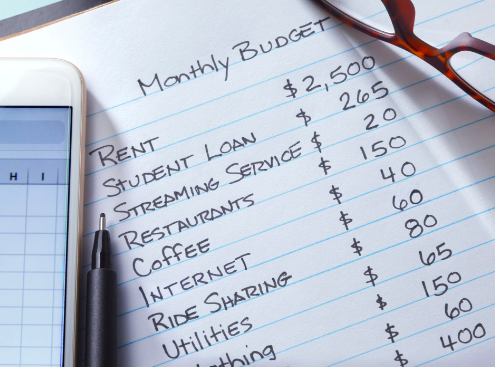

- Know Your Budget

Determine how much you can afford to spend on a home by calculating your debt-to-income ratio. This will help you avoid overspending and ensure you can comfortably make your mortgage payments. Consider factors like property taxes, insurance, and maintenance costs when determining your budget.

- Get Pre-Approved for a Mortgage

Once you have a good understanding of your finances, it’s time to get pre-approved for a mortgage. This will give you an idea of how much you can borrow and what your monthly payments will be. To get pre-approved, you’ll need to:

- Contact a lender or mortgage broker and provide financial documentation

- Discuss your loan options and choose the best one for your situation

- Receive a pre-approval letter stating the amount you’re approved for

- Identify Your Priorities

What are your must-haves in a home? Do you need a specific number of bedrooms and bathrooms? Are you looking for a certain location or type of neighborhood? Make a list of your priorities to help guide your search. Consider factors like:

- Commute time to work or school

- Proximity to public transportation

- Amenities like parks, pools, or community centers

- Storage space and outdoor areas

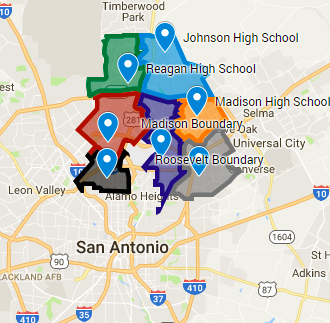

- Research Neighborhoods and Schools

The neighborhood and school district can significantly impact your quality of life and property value. Research areas that align with your lifestyle, preferences, and budget. Consider factors like commute time, public transportation, shopping options, and local amenities. If you have children, research the local school district’s reputation, curriculum, and extracurricular activities.

- Work with a Reputable Real Estate Agent

As a first-time homebuyer, you may not be familiar with the local market or the homebuying process. That’s where a reputable real estate agent comes in. Look for an agent who is knowledgeable about the area, has experience working with first-time homebuyers, and can guide you through the process from start to finish.

- Don’t Forget About Additional Costs

In addition to your mortgage payments, there are several additional costs to consider when buying a home. These may include:

Home inspections and appraisals- These are crucial steps in the home buying process. A home inspection can cost between $300 to $1,000, depending on the location, size, and age of the property. An appraisal can cost around $300 to $1,500. These costs can help you identify potential issues with the property and ensure you’re paying a fair price.

Title insurance and escrow fees- When buying a home, you’ll need to purchase title insurance to protect against any potential issues with the property’s ownership. This can cost around $1,500 to $3,000. Escrow fees, on the other hand, cover services like title insurance, appraisals, and other administrative tasks. These fees can range from $500 to $2,000.

Property taxes and insurance- As a homeowner, you’ll be responsible for paying property taxes, which can vary depending on the location and value of your property. You’ll also need to purchase homeowners insurance, which can cost around $800 to $2,000 per year.

Maintenance and repair costs- Once you’ve moved into your new home, you’ll need to budget for ongoing maintenance and repair costs. These can include things like plumbing issues, roof repairs, and appliance replacements. It’s a good idea to set aside 1% to 3% of your home’s value each year for these expenses.

HOA fees (if applicable)- If you’re buying a condo or townhouse, you may be required to pay Homeowners Association (HOA) fees. These fees cover maintenance and upkeep of common areas, such as swimming pools, gyms, and landscaping. HOA fees can range from $100 to $1,000 per month.

Keep in mind that these are just general estimates, and actual costs may vary depending on your location and specific circumstances. It’s essential to factor these additional costs into your budget when buying a home and discuss them with your lender and real estate agent to rule out any problems down the road.

Buying a home for the first time can be a daunting experience, but with the right guidance and preparation, you can achieve your dream of homeownership. By following these 5 essential tips, you’ll be well-equipped to navigate the market and find the perfect home for you. Remember to stay patient, do your research, and don’t hesitate to reach out to a reputable real estate agent like me for guidance along the way.

Justin Brickman