Texas Housing Insight

August brought positive developments to the Texas residential real estate sector. Despite persistent high interest rates, home sales increased by 9.5 percent on the consumer side, and construction permits rose by 5.3 percent on the supplier side. Notably, the median home price showed a slight decline, breaking a streak of seven consecutive increases. This drop was modest, around $800, possibly indicating a balanced market. With sellers holding onto pandemic-era low-rate homes and buyers facing rising costs, the housing market appears stable.

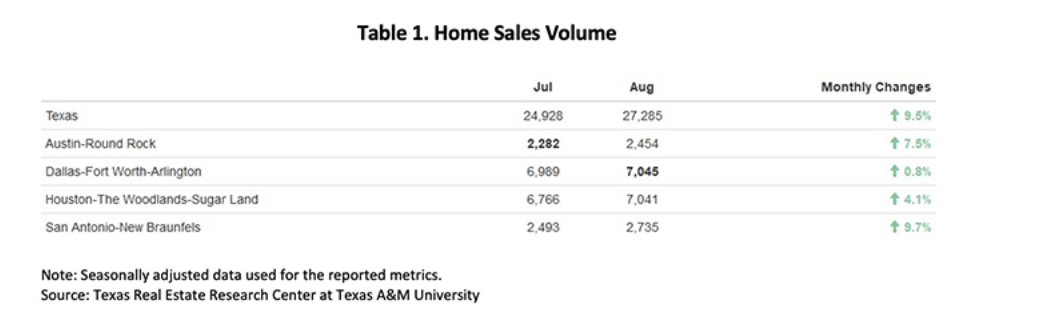

Resurging Home Sales Trim Market Time In a real estate slowdown, Texas saw an upswing in total home sales, bouncing back from a three-year low in the previous month. Over 27,000 transactions took place in August, a remarkable 9.5 percent month-over-month (MOM) increase, although still 8 percent lower than the previous year. Sales saw a uniform increase in all four major metropolitan areas, with growth ranging from 0.8 percent to 9.7 percent (see Table 1).

The decline in home sales was primarily due to restricted sales of existing homes, while the new construction market witnessed a 20 percent annual growth. Consequently, the market share of new construction sales rose by five percentage points to reach 21.7 percent. This suggests that for every five closed transactions, one involves a new home. Both demand and supply factors contributed to the rise in new home sales, with current homeowners hesitating to move to costlier properties.

After stabilizing at an average of 57 days for two months, the state’s average days on the market (DOM) decreased to 55 days, indicating a potential market stabilization. In the past six months, DOM fluctuated within the range of 55 to 59 days. Among major metropolitan areas, Austin (69 days) and San Antonio (66 days) had longer-than-average DOM, while Dallas and Houston reported DOM figures of 47 days and 48 days, respectively.

Increasing Housing Inventory as Listings Rise Housing supplies have been steadily growing, with active listings on the rise since February, and the pace of accumulation is accelerating. In August, the number of homes available for sale increased by 5.9 percent, reaching a total of 90,750 listings. The four major metropolitan areas all reported monthly gains, ranging from 4.4 percent to 5.2 percent, with Dallas leading the way. Texas, as a whole, saw new listings increase by 5.7 percent to 40,620 units, with Austin contributing a double-digit increase of 642 units. Despite the rise in active listings, the months of inventory (MOI) experienced a slight decrease to 3.2 months, primarily due to a resurgence in home sales.

Impact of High Mortgage Rates on Loan Applications Since the Federal Reserve began raising interest rates, both treasury rates and mortgage rates have seen corresponding increases. The ten-year U.S. Treasury Bond yield averaged 3.8 percent in 2023, up from 3 percent in 2022 and 1.5 percent in 2021. The expectation of further rate hikes pushed the bond yield to its highest level since the Great Recession in 2008, reaching 4.2 percent.

Elevated by the bond yield, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate inched up to 7.1 percent, marking a 23-basis point increase. The higher mortgage rate is expected to raise the overall cost of homeownership and decrease the number of mortgage applications. Under the pressure of these high mortgage rates, mortgage loan applications have fallen throughout 2023, with the annual peak occurring in January. Over the past eight months, the Mortgage Bankers Association has reported a 20 percent drop in the volume index.”