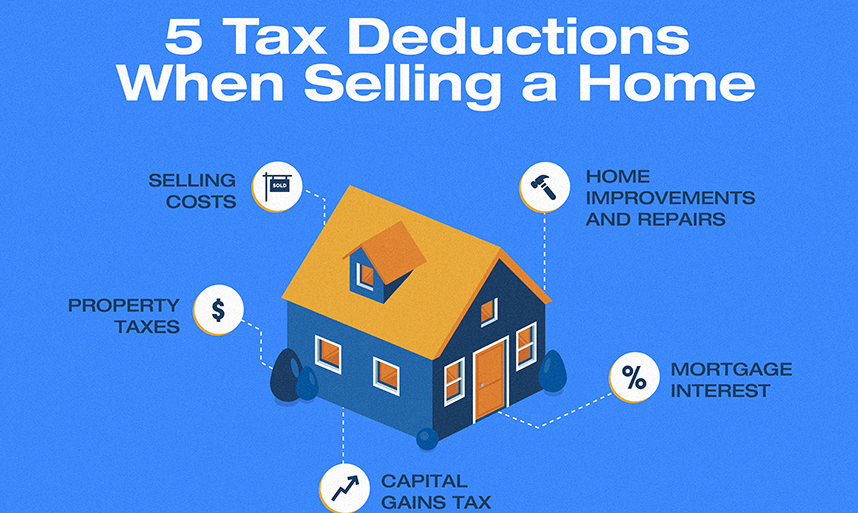

When you’re selling your house, understanding the tax implications and deductions can help you optimize your financial situation. Here are some key considerations related to tax deductions after selling your home:

- Capital Gains Tax Benefits

- In the United States, selling your primary residence can come with substantial tax benefits. As of my last knowledge update in September 2021, singles may exclude up to $250,000, and married couples filing jointly up to $500,000 in capital gains, provided certain ownership and usage requirements are met.

- Should your capital gains surpass these thresholds,you might be subject to capital gains tax on the excess amount.

- Leveraging Home Improvement Investments:

- Making strategic home improvements and renovations that boost your property’s basis can effectively reduce your capital gains. A higher basis means a lower taxable gain. Keep meticulous records of these enhancements for potential tax advantages.

- Calculating Closing Costs:

- While most closing costs cannot be deducted directly, they can be instrumental in diminishing your gain, subsequently lowering your capital gains tax.

- Accounting for Selling Expenses:

- Costs linked to the sale of your property, including real estate agent commissions, advertising expenses, legal fees, and escrow charges, can be instrumental in reducing your capital gain and, consequently, your tax liability.

- Exploring Moving Expenses:

- If your move is job-related and meets specific criteria, you may be eligible for a deduction on your moving expenses. However, it’s worth noting that the rules governing this deduction have undergone recent changes.

For a comprehensive approach to managing your taxes when selling your home, it’s advisable to consult with a qualified tax professional or accountant. They can guide you on the latest tax laws and ensure that you make the most of available deductions and exclusions. Tax laws can evolve, so staying up-to-date is essential to maximize your financial benefits when selling your house. Keep meticulous records of all relevant expenses and consult a tax professional to ensure full compliance with the most recent tax regulations.