Optimizing the 2-Out-of-5-Year Rule

Discover the potential for substantial tax savings when selling your primary residence by delving into the intricacies of the 2-Out-of-5-Year Rule. This IRS-mandated rule is your gateway to significant capital gains tax reductions, but understanding it in depth is crucial.

Your primary residence, categorized as a capital asset by the IRS, can potentially trigger capital gains tax liabilities if it has appreciated in value over the years. Yet, the tax code provides generous exceptions, which can substantially reduce your tax burden.

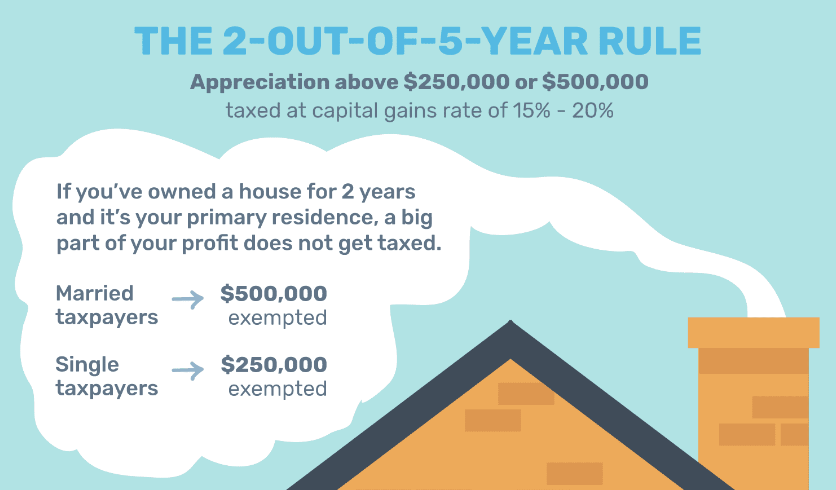

The IRS allows homeowners to exclude a considerable portion of the capital gains resulting from the sale of their primary residence. This exclusion empowers you to shield up to $250,000 of the gain from capital gains tax. For those who are married and file jointly, this exclusion threshold escalates to a noteworthy $500,000. However, to fully leverage these tax benefits, you must meet specific criteria, with the “2-out-of-5-year rule” taking center stage.

The 2-out-of-5-year rule stipulates that you must have both owned and resided in your primary residence for a minimum of two out of the last five years leading up to the sale. Notably, these two years need not be consecutive, and living in the property at the time of sale is not a strict requirement. The flexibility of this rule is a game-changer, allowing you to access this exclusion each time you sell your primary residence, albeit with the caveat that you can claim it only once every two years.

The ownership and occupancy periods offer remarkable flexibility. For example, you can reside in your home for a year, convert it into a rental property for three years, and then move back in for a year before the sale. Astonishingly, this scenario aligns with IRS guidelines for a primary residence, illustrating the rule’s adaptability to diverse living situations.

In cases where you cannot meet the two-year residence requirement, exceptional circumstances come into play, providing a lifeline for tax benefits. These exceptions, rooted in unique situations, allow you to exclude a portion of the gain from capital gains tax. Exceptional scenarios include separation or divorce, the unfortunate event of a spouse’s demise, the sale of vacant land, and other specific cases.

The historical evolution of these rules adds depth to your tax strategy. In 1951, Congress introduced a capital gains tax deferral for homeowners under Section 112 of the Internal Revenue Code. Subsequently, in 1997, Congress introduced substantial improvements by repealing older rules and introducing Section 121. This new rule not only eliminated age restrictions but also expanded the exclusion limit, making it more accessible and flexible for homeowners.

In summary, comprehending the nuances of the 2-Out-of-5-Year Rule is essential for homeowners looking to maximize their financial gains when selling their primary residence while minimizing tax liabilities. It’s important to note that tax laws are dynamic and subject to change. Staying updated is paramount. Seek guidance from a tax professional for the most accurate and current insights on the sale of your primary residence and the associated tax implications, ensuring you make the most of this tax-saving opportunity. Don’t miss out on the potential tax benefits when selling your home; start by mastering the 2-Out-of-5-Year Rule. It’s your key to a tax-efficient home sale and financial peace of mind.