How Home Equity Can Make a Move Possible

As a realtor, I’ve seen countless clients achieve their dreams of moving into a new home. But what happens when the financial hurdles seem insurmountable? That’s where equity comes in – the secret sauce that can make a move possible. In this blog post, I’ll dive into the world of equity and explain how it can help you unlock the door to your new home.

What is Equity?

Equity is the difference between the market value of your property and the amount still owed on your mortgage. For example, let’s say your home is worth $500,000, and you still owe $300,000 on your mortgage. In this case, your equity would be $200,000 ($500,000 – $300,000). This means that you have a significant amount of wealth tied up in your property, which can be used to fund your next move.

Your equity grows as you pay down your loan over time and as home prices climb. And thanks to the rapid home price appreciation we saw in recent years, you probably have a whole lot more of it than you realize.

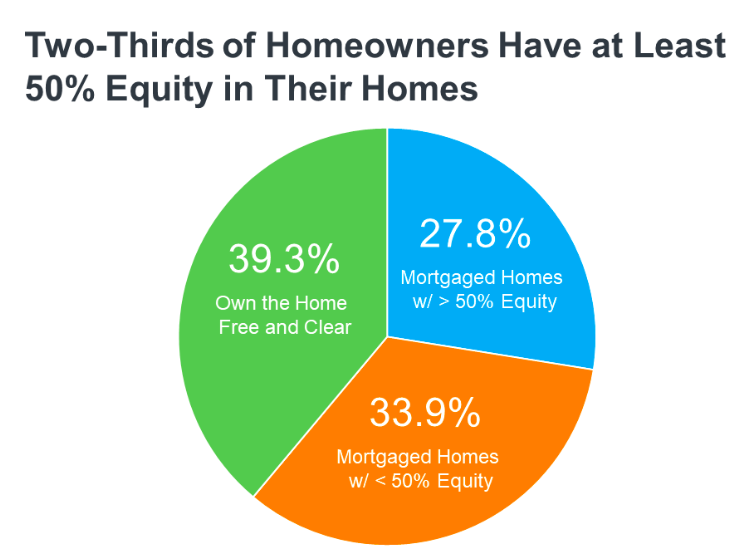

The latest from the Census and ATTOM shows more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

Think of equity as a simple math equation.

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.” – Freddie Mac

How Equity Can Make a Move Possible:

- Down Payment: With a significant amount of equity, you can use it as a down payment on your new home. This can reduce the amount you need to borrow, making it easier to qualify for a mortgage.

- Funding Renovations: If you’re planning to renovate your new home, equity can be used to cover some or all of the costs. This can help you avoid going into debt or dipping into your savings.

- Closing Costs: Equity can also be used to cover closing costs, such as title insurance and appraisal fees, which can add up quickly.

- Reducing Debt: If you’re carrying high-interest debt, such as credit card balances, you can use equity to pay off some or all of these debts. This can help reduce your monthly expenses and free up more cash for other uses.

- Funding Home Inspections: Equity can be used to cover the cost of home inspections, which are crucial in identifying potential issues with a property.

- Funding Appraisals: Equity can also be used to cover the cost of appraisals, which are often required by lenders to determine the value of a property. An appraisal typically costs between $300-$1,000. You can use your equity to cover these costs and avoid going into debt.

- Funding Pest Inspections: Equity can be used to cover the cost of pest inspections, which are often required by lenders to identify potential issues with a property’s foundation or structure. A pest inspection typically costs between $200-$500. You can use your equity to cover these costs and ensure that you’re making an informed decision when purchasing your new home.

- Funding Termite Inspections: Equity can also be used to cover the cost of termite inspections, which are often required by lenders to identify potential issues with a property’s foundation or structure. A termite inspection typically costs between $200-$500. You can use your equity to cover these costs and avoid going into debt.

- Funding Home Warranty: Equity can be used to cover the cost of a home warranty, which provides protection against unexpected repairs and replacements for major systems and appliances in the home. A home warranty typically costs between $300-$1,000 per year. You can use your equity to cover these costs and ensure that you’re prepared for any unexpected expenses that may arise.

- Funding Homeowners Insurance: Equity can also be used to cover the cost of homeowners insurance premiums, which can range from $800-$2,000 per year depending on the location and value of the property. You can use your equity to cover these costs and ensure that you’re properly protected against unexpected events.

Real-Life Examples:

- John and Sarah: John and Sarah own a home worth $800,000, but they still owe $400,000 on their mortgage. They have an equity balance of $400,000, which they use as a down payment on their new home. They’re able to avoid paying private mortgage insurance (PMI) and secure a lower interest rate.

- Emily: Emily owns a condo worth $300,000, but she still owes $200,000 on her mortgage. She has an equity balance of $100,000, which she uses to fund renovations on her new home. This allows her to avoid going into debt and maintain her cash reserves.

- David: David owns a house worth $500,000, but he still owes $300,000 on his mortgage. He has an equity balance of $200,000, which he uses to pay off some of his high-interest debt. This helps him reduce his monthly expenses and free up more cash for other uses.

Equity is a powerful tool that can help make a move possible. Whether you’re looking to reduce debt, fund renovations, or simply have more financial flexibility, equity can be the key to unlocking your dreams. As a realtor, I’ve seen firsthand how equity can help clients achieve their goals and make their next move a reality.

If you’re considering using your equity to make a move possible, don’t hesitate to reach out to me. I’d be happy to help you navigate the process and provide guidance on how to make the most of your equity.

Take control of your finances and make your next move possible. Contact me today to schedule a consultation and discover how equity can unlock your dreams.

Justin Brickman