Housing Market Forecast

in San Antonio

In spite of recent demand downturns resulting from the sustained presence of mortgage rates at the 6% to 7% range, San Antonio’s housing market demonstrates impressive resilience. Home prices have appreciated while remaining well within affordability, bolstered by a robust employment landscape. Additionally, there’s a discernible upswing in both builder and consumer sentiment. Join us as we explore the outlook for San Antonio’s housing market in the coming months.

How the San Antonio Housing Market Changed in 2022

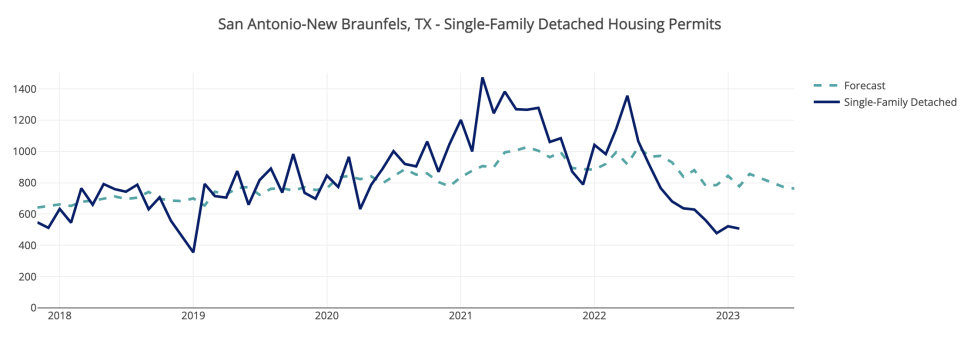

In 2022, there was a substantial decline in single-family building permits in San Antonio. These permits dropped from 1,357 in April to a mere 478 by the end of the year, and they have remained at this level ever since.

Between December 2022 and February 2023, a total of 1,507 single-family permits received approval within the San Antonio metropolitan statistical area (MSA), encompassing the nearby area of New Braunfels. This marks a stark contrast to the previous year when a significant 2,814 permits were granted, signifying a notable 46% decrease within just a 12-month period.

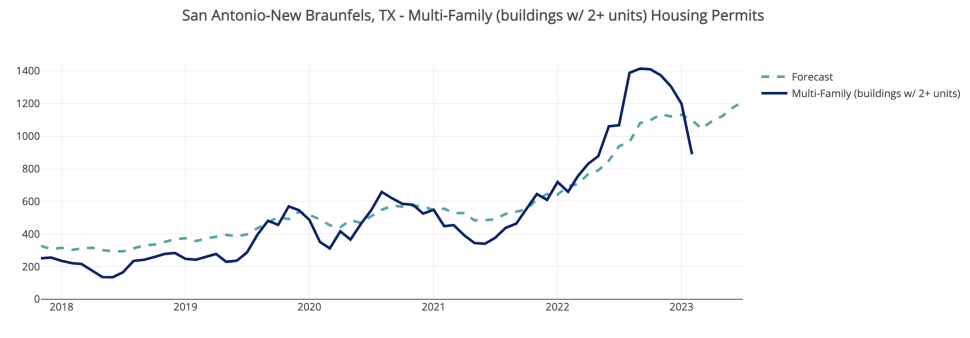

In 2022, multifamily permits in San Antonio experienced significant fluctuations, reaching their peak with 1,414 permits approved in September but declining to 1,306 in December. This decline has persisted and steepened in the following months.

Nevertheless, it’s worth noting that permits have seen a substantial increase when compared to the prior year. From December 2022 to February 2023, a total of 3,393 multifamily permits received approval in San Antonio, a significant contrast to the 1,987 permits approved during the same three-month period the year before. This represents an impressive year-over-year increase of 71%.

San Antonio Housing Supply and Demand

The housing supply situation in San Antonio has seen significant improvement. The metropolitan statistical area (MSA) currently boasts a 3.9-month supply of homes for sale, a notable increase from the meager 1.5 months recorded just one year ago. This figure also surpasses the national supply level, which presently stands at a mere 2.6 months. San Antonio is getting closer to the benchmark of six months of supply, typically considered the equilibrium point between supply and demand for property listings.

However, despite these improvements, local real estate agent Rich Rupp emphasizes that this progress is merely steering the region towards “a more balanced market.”

“In San Antonio, we are going to be short on supply for the foreseeable future,” states Rupp, who is the owner of RE/MAX North-San Antonio.

Elevated mortgage rates are likely responsible for the dwindling vacancies in the housing market. As these rates push some potential buyers out of the market, they are compelled to turn to renting, leading to a decrease in vacancy rates. Data from the Mortgage Bankers Association for the week of April 14 shows that applications to purchase a home were down by 8.8% from the previous week. On an unadjusted basis, the Index decreased by 9% compared to the previous week and a substantial 36% year-over-year, reflecting a recent surge in mortgage interest rates that prompted a decline in application activity.

These higher mortgage rates are also having a negative impact on consumer sentiment. According to a survey conducted by the University of Michigan, current consumer sentiment stands at 64.9 out of 100, representing a 2.3-point decrease compared to the previous year and falling significantly below the pre-pandemic average. In the period from 2018 through early 2020, consumer sentiment consistently ranged in the high 90s.

Fortunately, according to real estate agent Rich Rupp, buyers are often able to mitigate the impact of these higher rates, typically through seller-paid buydowns.

“Sellers are more willing to negotiate,” Rupp says. “The majority of that is in the form of seller-paid closing costs, helping the buyer with closing expenses and giving them the funds to buy down their interest rate.”

San Antonio Real Estate Market: Predictions

Our forecasts predict an uptick in multifamily building permits, but single-family ones should hold steady. This will keep housing supply low in the area and, coupled with a strong jobs market and improving consumer and builder sentiment, ensure a strong housing market in San Antonio for the foreseeable future.

The one wild card is interest rates. As Rupp puts it, “A lot will depend on how rates shake out. The better rates we have, the higher demand will go.”