Texas Homeowners ‘Devastated’ Despite Greg Abbott’s Property Taxes Move

Greg Abbott’s $18 billion tax cut package for Texas homeowners came into force on Monday, but many residents complained to Newsweek that they are still facing impossibly high taxes on their homes.

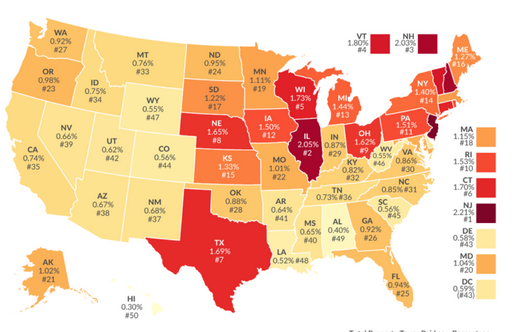

Property Taxes by the state

Despite having no personal income tax—a perk that has attracted many to move to the Lone Star State—Texas has some of the country’s highest taxes. Abbott campaigned for re-election in 2022 with the goal to ease this financial pressure on the state’s residents, and last year he put to voters a decision over his tax cut package.

Texans overwhelmingly voted in support of the historic measure, which increased the amount of a home’s value that cannot be taxed to pay for public schools from $40,000 to $100,000. Republican Senator Paul Bettencourt of Houston said the bill would help Texas residents to save on average $1,300 a year in property taxes.

Some Texans told Newsweek they were pleased by the measure. But many others wrote to complain that they’re not eligible for the homestead exemption or that they’re still paying burdensome taxes despite benefiting from the raise in the exemption. The blame was not laid entirely at Abbott’s door, with the appraisal system coming in for particular criticism.

One way to ease the tax burden across Texas is to buy down school districts’ maintenance and operations (M&O) taxes, which is about half of the property tax burden. This could be done by limiting state spending and using any surplus funds to cut the local property tax until it is eliminated, which could take roughly a decade, moving Texas towards sales taxes as they are the state’s top revenue source. However, this could be difficult to maintain session after session with the limitations on state and local government spending to achieve this in a timely manner, if at all.

Another way is for the state to immediately replace school M&O taxes with higher sales taxes. An immediate swap would eliminate the risk that the switch to a final sales tax would be only temporary, a failure common to past Tax relief efforts. However, an immediate switch may be politically challenging to implement, so a way to mitigate this is to limit state spending and use surplus funds to cut the sales tax rate over time.

Switching M&O costs to sales taxes is not the only measure local (or state) governments should adopt. The other, and possibly even more fundamental to reducing barriers for opportunities to let people prosper, is implementing sound budgetary practices.

By reducing government spending through things like freezing new hires and pay raises and placing a moratorium on incurring any new taxpayer-funded debt, there are plenty of opportunities to cut taxes.

Local governments should volunteer for third-party audits to determine where areas of waste can be eliminated along with expensive lobbying contracts and longevity pay. Ultimately, practicing zero-based-budgeting, whereby local governments must justify every expenditure, could help achieve setting budget priorities that support effective government programs.

Any government approach to supporting an economic recovery in the wake of COVID-19 must begin with easing the burden on Texas taxpayers, and that approach must include reducing the burden of soaring taxes and implementing sound budgeting at all levels of government.

The article accompanying the map acknowledges that Texas to some extent relies on high taxes in lieu of other tax categories – i.e., income taxes – though other states without an income tax do not necessarily have a high tax burden (e.g., Florida). Regardless, in an economy hampered by COVID-19 and government lockdowns and with homeowners under substantial financial and mental stress, local governments have a responsibility to reduce the burden on taxpayers.

Justin Brickman

RENE | Real Estate Negotiation Expert

SRS | Seller Representative Specialist

All City Real Estate

San Antonio, Texas

210-827-6020