A Comprehensive Guide:

Tax Deductions When Selling Your Home

Selling your home involves more than just finding the right buyer; it’s about strategically navigating the tax landscape to optimize your financial outcomes. In this detailed guide, we’ll explore key tax considerations and deductions, ensuring you make informed decisions for a seamless home sale.

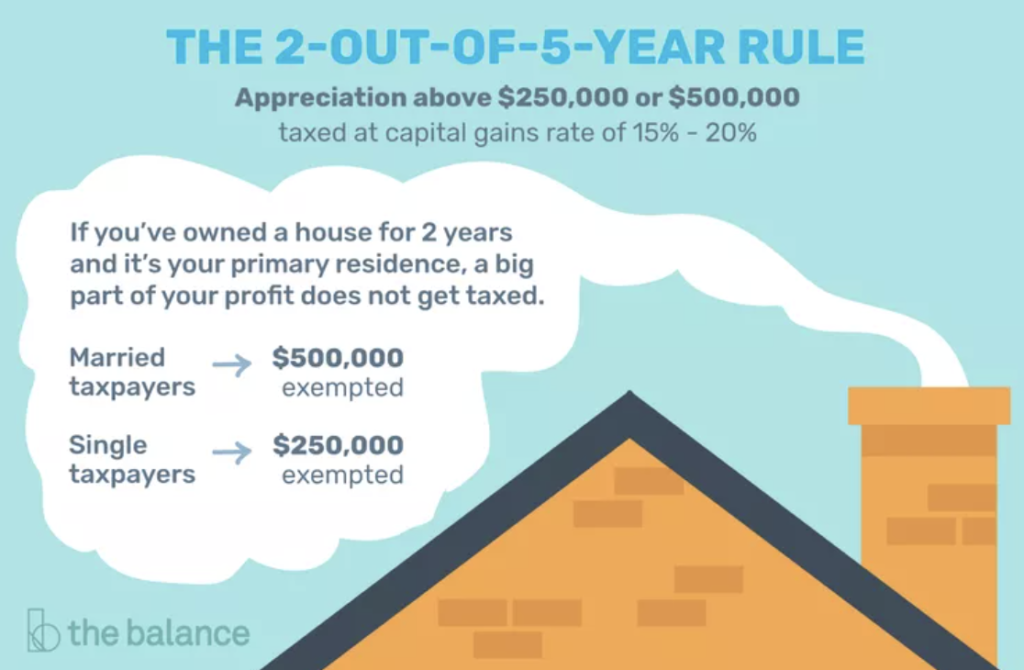

- Capital Gains Tax Exclusion:

- Discover the latest updates on the capital gains tax exclusion in the United States. Singles can potentially exclude up to $250,000, while married couples filing jointly may enjoy a $500,000 exclusion. Stay compliant with ownership and usage requirements to maximize this tax benefit.

- Leveraging Home Improvement Tax Breaks:

- Boost your property’s basis strategically with home improvements and renovations. These enhancements not only enhance your living space but can also reduce your capital gains. Keep meticulous records to maximize your tax advantages.

- Strategic Closing Cost Management:

- While many closing costs can’t be directly deducted, understanding how to leverage them can significantly impact your overall gain. Explore ways to use closing costs to your advantage, potentially lowering your capital gains tax.

- Optimizing Selling Expenses:

- Realize the impact of selling expenses, such as real estate agent commissions, advertising costs, legal fees, and escrow charges. Learn how to strategically use these expenses to reduce your taxable gain and potentially lower your tax liability.

- Moving Expense Deductions:

- Unpack the details of moving expense deductions, especially if your move is job-related. Changes in the rules have occurred, so staying updated ensures you maximize this deduction, potentially saving on your tax bill.

- Navigating State-Specific Tax Rules:

- Each state has its own rules on capital gains tax for home sales. Understand the specifics applicable to your state, ensuring compliance and potentially unlocking additional tax benefits.

For a personalized approach to managing your tax implications when selling your home, consult with a qualified tax professional or accountant. Stay informed on the latest tax laws to capitalize on available deductions and exclusions. Keep detailed records of your expenses for a seamless tax filing process.

Ready to optimize your tax strategy? Explore our in-depth resources and expert insights to make the most of your home sale.

Justin Brickman, Best Realtor

All City Real Estate

Seller Representative Specialist

Real Estate Negotiations Expert

Military Relocation Professional