THE STATE OF REAL ESTATE INVESTING

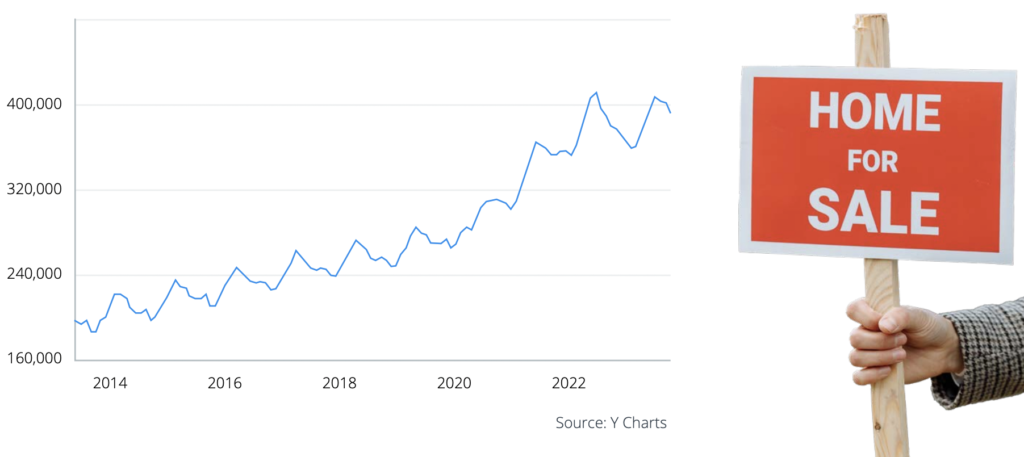

US Existing Home Median Sales Price

In 2023, the residential real estate sector experienced unexpected developments. Despite a significant increase in mortgage rates, which more than doubled throughout 2022 and continued to climb in 2023, many anticipated a market correction. However, as of September 2023, housing prices have defied expectations by registering a notable 2.8 percent growth compared to the previous year

Optimizing Your 2024 Real Estate Strategy: Key Insights for Smart Moves

Unlock success in the 2024 real estate market by leveraging crucial insights and SEO keywords. Stay ahead with a data-driven approach:

- Interest Rates and Mortgage Trends:

- Stay informed on prevailing interest rates and mortgage trends to assess their impact on housing demand and affordability.

- Economic Indicators for Real Estate:

- Align your strategy with economic indicators like GDP growth, employment rates, and consumer confidence to make data-driven decisions.

- Supply and Demand Dynamics in Real Estate:

- Analyze the balance between housing supply and demand in your target market, optimizing your positioning based on market conditions.

- Local Real Estate Market Conditions:

- Customize your approach by understanding the unique factors influencing your local market, including job growth, population trends, and infrastructure development.

- Technology and Real Estate Innovation:

- Embrace proptech innovations and stay ahead of industry trends, incorporating virtual tours, blockchain, and smart home technologies into your real estate strategy.

- Regulatory Changes Impacting Real Estate:

- Stay compliant and proactive by monitoring regulatory changes and policy shifts affecting zoning, taxes, and government initiatives in the real estate sector.

- Environmental Considerations in Real Estate:

- Address the growing demand for eco-friendly properties by evaluating the market for energy-efficient and sustainable housing options.

- Demographic Shifts in Real Estate:

- Tailor your strategy to changing demographics, considering factors such as population growth, age distribution, and evolving lifestyle preferences.

- Remote Work’s Influence on Real Estate:

- Capitalize on the impact of remote work by understanding how it shapes housing preferences and influences demand in specific areas.

- Real Estate Market Sentiment Analysis:

- Stay attuned to market sentiment through public perception, media coverage, and real estate forecasts, ensuring your strategy aligns with prevailing trends.

2023 Outlook for Home Buyers

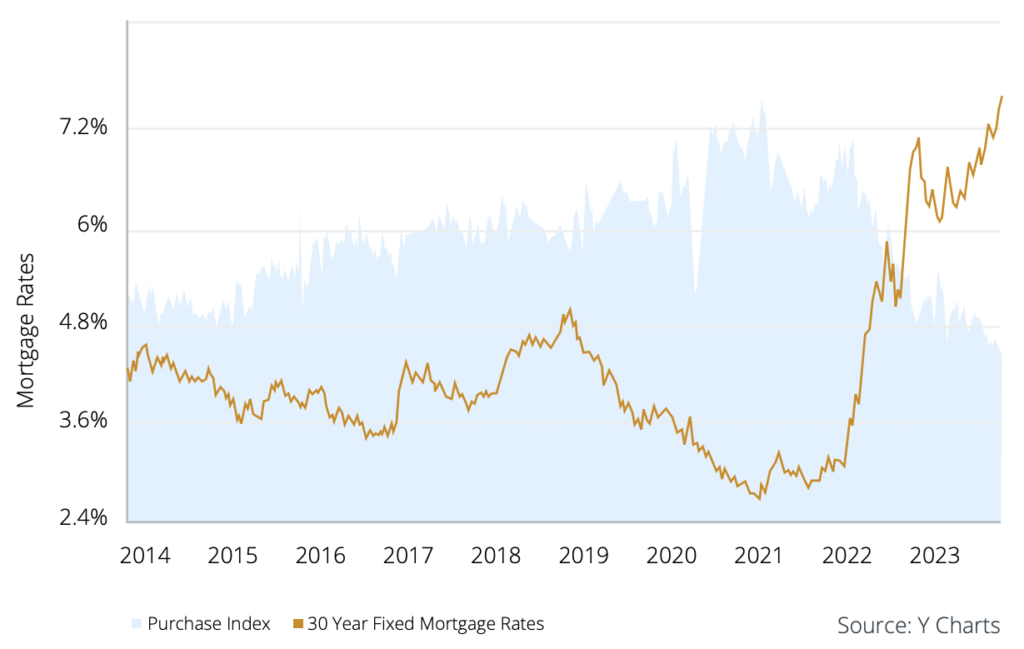

As anticipated, the diminishing affordability in the real estate market has prompted a notable exodus of buyers, resulting in a substantial decline in demand. Recent data from the Mortgage Bankers Association reveals a striking 14 percent decrease in the demand for purchase mortgages within the past year, reaching its lowest point in over 25 years. While a dip in demand typically triggers a decrease in prices across most markets, the housing sector exhibits a unique trend.

Surprisingly, over 70 percent of sellers in the housing market have expressed an intention to purchase another home. However, the challenge arises when buying conditions become financially impractical, making the prospect of selling less appealing. For the majority of existing homeowners, acquiring a new property under current mortgage rates proves to be financially unwise. A staggering 90 percent of homeowners currently hold mortgages under today’s rates, with many experiencing disparities of several hundred basis points.

Illustratively, consider a home with three bedrooms and two bathrooms in the Tampa Bay, Florida area. If valued at $360,000 in 2021 with a 3.5 percent interest rate, the monthly payment stood at $1,293. Contrastingly, if the same property is now valued at $400,000 with a 7.5 percent interest rate, the monthly payment skyrockets to about $2,237—an alarming 73 percent increase for the same property.

This phenomenon, coined as “the lock-in effect,” signifies homeowners refraining from selling due

to escalating interest rates. It is a predominant factor contributing to the drastic reduction in housing market supply. New listings, representing the number of properties entering the market each month, have plummeted to levels not witnessed in over a decade. Concurrently, inventory, reflecting the quantity of units available for sale monthly, has experienced a significant 12 percent year-over-year decline.

Justin Brickman, Best Realtor

All City Real Estate

Seller Representative Specialist

Military Relocation Professional

210-827-6020